Sensex Today | Stock Market Live Updates : Global stock markets are on course on Friday for a week of heady gains as AI darling Nvidia’s stunning results sparked a wave of record highs from Asia to Europe and the U.S., while the yen nursed losses on a range of currencies.

European markets pointed to higher openings with EUROSTOXX 50 futures up 0.1% and FTSE futures gaining 0.2%. U.S. futures were mostly flat.

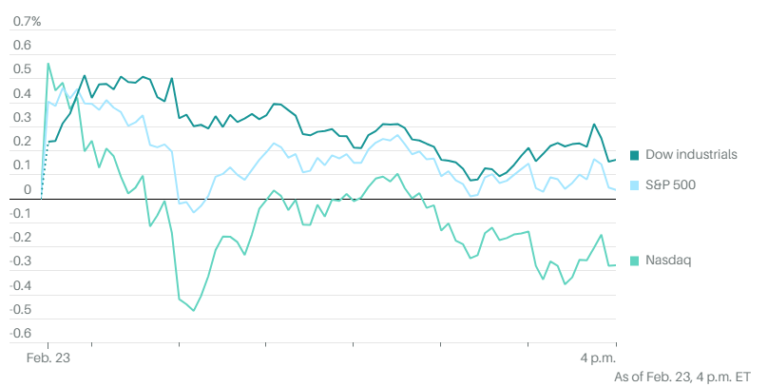

Nvidia surged 16.4% overnight, adding a record $277 billion in market value. The company’s results supercharged a global AI-led rally in technology stocks, propelling the S&P 500 , the Dow Jones Industrials, Europe’s STOXX 600 and Japan’s Nikkei share average to record highs.

Japan is closed for a public holiday on Friday, but Nikkei futures rose nearly 1%, suggesting Japanese stocks will extend their record run next week.

Some regional tech shares took a breather after a stellar rally this week, but MSCI Asia-Pacific ex-Japan IT index still put on 0.3% to its highest level since March 2022.

MSCI’s broadest index of Asia-Pacific shares outside Japan pared early gains to be up 0.2% and was heading for a weekly gain of 1.3%.

The Shanghai Composite index rose above the psychologically key 3,000-point mark before retreating to trade 0.3% higher. It is up 4.6% for the week and has bounced about 10% from five-year lows set more than two weeks ago.

Hong Kong’s Hang Seng index slipped 0.2%.

Oil prices fell after climbing on supply fears as hostilities in the Red Sea showed no signs of abating. A large build in U.S. crude inventories also weighed.

Brent eased 0.5% to $83.23, while U.S. crude slipped 0.6% to $78.17 per barrel.

The spot gold price was flat at $2,022.22.

Rewritten Content:

Sensex these days | stock marketplace live Updates : global stock markets are on route on Friday for per week of heady gains as AI darling Nvidia’s lovely results sparked a wave of record highs from Asia to Europe and the U.S., whilst the yen nursed losses on a number currencies.

ecu markets pointed to better openings with EUROSTOXX 50 futures up zero.1% and FTSE futures gaining 0.2%. U.S. futures were primarily flat.

Nvidia surged sixteen.four% in a single day, adding a report $277 billion in marketplace cost. The corporation’s outcomes supercharged a global AI-led rally in technology stocks, propelling the S&P 500 , the Dow Jones Industrials, Europe’s STOXX 600 and Japan’s Nikkei share average to file highs.

Japan is closed for a public excursion on Friday, however Nikkei futures rose almost 1%, suggesting eastern shares will increase their report run subsequent week.

a few regional tech stocks took a breather after a stellar rally this week, however MSCI Asia-Pacific ex-Japan IT index nevertheless placed on 0.3% to its maximum stage in view that March 2022.

MSCI’s broadest index of Asia-Pacific stocks out of doors Japan pared early profits to be up 0.2% and turned into heading for a weekly benefit of 1.3%.

The Shanghai Composite index rose above the psychologically key 3,000-point mark earlier than retreating to alternate zero.3% higher. it’s far up four.6% for the week and has bounced approximately 10% from five-year lows set extra than weeks in the past.

Hong Kong’s dangle Seng index slipped zero.2%.

Oil charges fell after hiking on supply fears as hostilities within the purple Sea confirmed no symptoms of abating. A big build in U.S. crude inventories also weighed.

Brent eased zero.five% to $eighty three.23, whilst U.S. crude slipped zero.6% to $seventy eight.17 according to barrel.

The spot gold charge turned into flat at $2,022.22.